Succession Planning Essentials for Solopreneurs

September 25th, 2019 · 4 min read

- Life happens: not having a succession plan is risky for you and unfair to your clients

- With succession planning, you can arrange to sell your book of business at a moment’s notice, even sock cash away to fund an emergency transition period

As a solopreneur in financial service — whether investment advisor, CPA, insurance agent, or attorney — your obligations to clients, and your own best interests, dictate making a viable and fully realized succession plan an absolute priority.

It takes guts to go it alone in the financial-service industry. And it takes planning to be an effective “solopreneur” against a competitive backdrop that includes larger independents and national brands.

But you’ve weighed the options and made your choice. Now, you’ve either made the leap to independence as a sole practitioner, or you’re counting down the days.

To make sure you’re maximizing time on customer care rather than operational busywork, you’re hooked up with the vendors you need, at prices you can live with. CRM, billing, compliance, and other mission-critical functions are on your desktop or a quick call away. In place to are benefits like health insurance and a retirement-savings account because you wouldn’t make a move like this without taking care of your family and your future.

That’s not all. Your clients admire the move you’ve made, and their new-business referrals put a spring in your step.

It’s all falling into place. You want a work-life rooted in an unwavering focus on the client, free from crippling hierarchies and soulless rigidity. And you’re well on your way because you know what you’re doing.

Then along comes the proverbial bus, traveling at a high rate of speed while you’re looking the other way.

You survived the impact, thank goodness, but you’re in traction. And once you’re able to get around a bit, physical therapy will take up your time for a good while. So maybe a full-time return to work isn’t in the cards, not soon enough to meet your clients’ needs, and not to the degree they’ve come to expect.

Or maybe your mom suddenly needs help.

You’re an only child, and you refuse to oversee her care from a distance. So you’re moving back. It’s the right thing to do. Your clients? Oh, you can look after them from afar — I mean, it’s new to them, and it’s not what they signed on for. But you can do it; probably, for a while.

In other words, life happens.

So, with that in mind, here’s an important question. Do you have a succession plan?

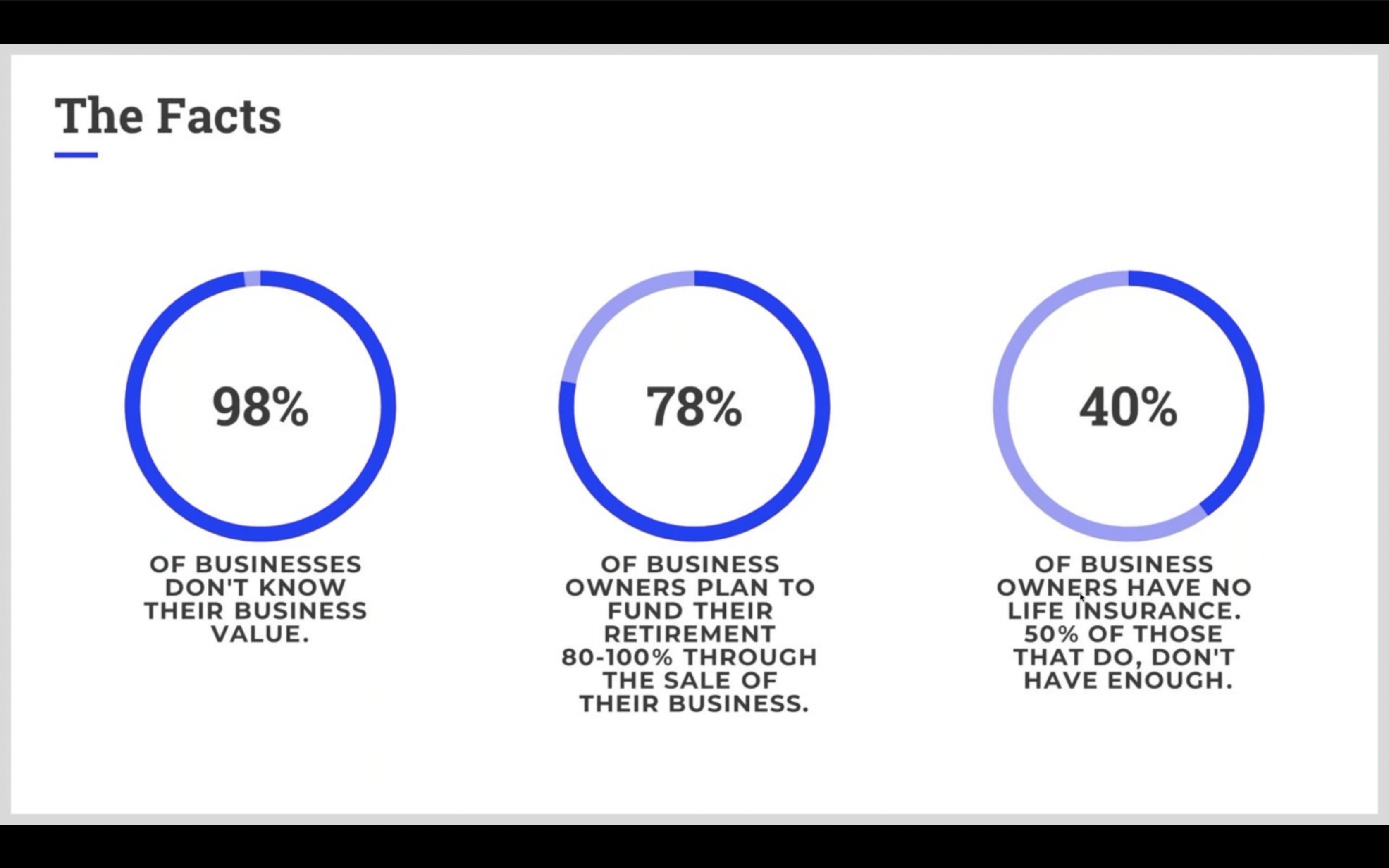

Most solopreneurs don’t say industry sources. In addition, most entrepreneurs don’t know how much their businesses are worth, more than three quarters count on selling their businesses to fund their retirements, and more than half of them either don’t have enough life insurance or lack it altogether.

This prevalence of unpreparedness is a shame for a couple of reasons.

First, and obviously, a lack of business succession planning on your part can lead to things you’re apt to feel bad about: abandoned clients, disheartened employees, and a pile of unpaid bills.

Second, it’s not like you’re selling lace doilies on Etsy. Shutter the typical micro-business without warning and few will notice: customers will look for you, not find you, and move on. That’s not a responsible — and in some cases, it’s not a legal — option for a financial-service solopreneur.

Besides good governance and common decency, there’s another great reason to have a succession plan. It forces you to understand the real value of your practice and how to pass it on to your maximum benefit.

A succession plan, for which there are experienced consultants, forces you to consider options like selling to an outside buyer, passing on to a family member or handing off to a colleague.

There are even firms that can guide you through the process of selling your book of business so that you can have a signed agreement in place now for a transaction that may take place months, years or even decades hence — and it may be something you can revoke at any time.

But it’s vital to understand the succession-planning process isn’t only about selling the shop. It also puts in place a vital document trail that, as a minimum, consists of:

- A power of attorney

- A letter of instruction and other vital docs (including mission-critical logins)

- Adequate life insurance

- A “winding-up account” with at least three months’ business expenses to give specified agents the means to pay vendors, close accounts, and perhaps facilitate a sale